Ever since the Beijing-based conglomerate China Oceanwide Holdings acquired two sites in New York’s South Street Seaport from Howard Hughes Corp. in the Financial District in 2016 for $390 million, the site’s future has remained as opaque as the company itself. Oceanwide apparently planned to build a mixed-use supertall as high as 1,436 feet at 80 South Street (which includes the second site it purchased from Howard Hughes at 163 Front Street).

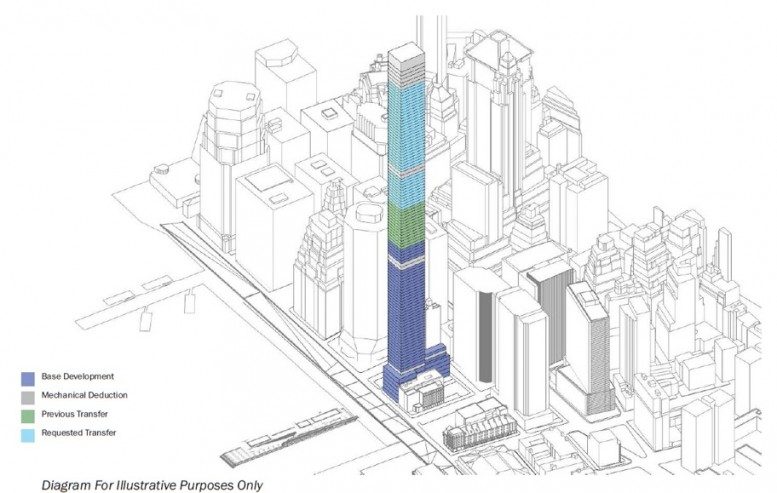

In February 2016, China Oceanwide secured approval from the City Planning Commission for the transfer of an additional 426,940 square feet of air rights to the site for a combined total of 1,067,350 square feet, including 512,300 square feet for residential units. In May 2017, the company submitted plans to demolish the existing buildings at the site.

However, since then there has been a remarkable lack of activity. No demolition work has been carried out at either of the two sites purchased from Howard Hughes and no plans have been submitted to the city’s Department of Buildings. Despite this complete lack of activity since 2016, an announcement to shareholders by China Oceanwide on August 30th , 2018 covering the preceding six months stated with regard to 80 South that “the conceptual design of the project has been completed and the schematic design is currently in progress” without providing any further details.

The lack of activity at 80 South might not seem particularly significant if it were an isolated case. But China Oceanwide has been on a massive real estate buying spree, fueled by a seemingly limitless access to credit made possible perhaps in part by the conglomerate’s opaque structure (it has more than 100 subsidiaries) and good political connections. 80 South is just one of a number of Oceanwide’s real estate development mega projects in the U.S. which have been stalled for years.

For example, the company purchased the site for its planned Oceanwide tower in San Francisco for $300 million in 2016. Estimates peg this development as the most expensive construction project in San Francisco with an estimated cost of $1.6 billion. Oceanwide began construction towards the end of 2016 but a Curbed article from early 2018 called the project “little more than a dream, a smile, and a pile of construction equipment.”

The same picture can be seen with Oceanwide’s land purchases on the west side of Oahu, where the company acquired 26.3 acres of land in 2016 for $280 million with plans to build a 1,324-unit Atlantis Resort. However, in June 2018 the company reported it was still in “the early design and planning process” for its first Hawaii development and the vice president of its Hawaii subsidiary was quoted as saying he had “no idea of the specific timeline” of when construction will begin.

The writing seems to be on the wall that the good times are coming to an end for China Oceanwide. The S&P has a CCC+ rating on the conglomerate’s principal operating entity and described its capital structure as unsustainable. The company’s recent purchase of the financial services company Genworth appears to be a short-term play to extract as much capital as possible in an attempt to remain solvent.

Subscribe to YIMBY’s daily e-mail

Follow YIMBYgram for real-time photo updates

Like YIMBY on Facebook

Follow YIMBY’s Twitter for the latest in YIMBYnews

Beginning of fall of “great” China…

With Real Estate rising, seems like they have amassed some valuable land & profits.

And now all their dream projects failing, as card stacked house. You pull one card and everything collapse. China is Communist Dictatorship again, and not anymore business friendly, their dream shiny temples on the Hill are now became broken shards of glass!!!

China’s government and economy are a lot more complex than that. China, like the United States, is a mixed capitalist economy with socialist aspects. It can be more extreme in both directions, especially when considering special districts. The country is governed technocratically by a ruling single party of elites and experts in fields like engineering and planning.

“Beginning of fall of “great” China…”

And America being dragged down with it, starting with New York.

America don’t graded down with it, China holding of US assets reduced, China holding of US bonds (debt) is reduced more. China Oceanwide Holdings is nothing more than pyramid schame, 100 undisclosured subsidaries, how United States would affect of bankruptcy of biggest China government controlled, 51% of shares, foreign real estate Conglomerate. S&P is already downgraded it to CCC+, so it’s on verge of bankruptcy, then State of NY will take over their projects in NY State territory, and btw, from 23 trln debt, US debt owed less than 8 trln to foreign entities, the rest is owed to own US banks and members of Federal Reserve, or 15 trlns.US to China debt is now less than 700 bln. Remember China already reduced US bonds holding before Trump election, from 1,8 trln peak in 2012 to 922 bln in 2016, since that China reduced US bond holdings to less than 690 bln. China US held assets reduced accordingly to less than 500 bln. Now with insolvency of biggest China real estate holding, they are really fk up, they already have ghost mega cities, empty office buildings, empty malls, their infrastructure projects are also will cripple if foreign investors are walking out. US now much less depends on China’s investing in our economy we are more dependent for European Union and England investments than China now. And NY real estate is booming because US economy booming. And all these projects in NY on empty lots for years, how long a lot for 80 South is sitting empty, with zero construction activity!??? Since 2001 perhaps, the year of 9/11!!!

I guess soon there will be a pick up on South Street

I know of at least 3 architectural firms that this project has passed through. I suspect none of them were being paid or paid on time…this explains why.

Please pardon me for using your space: I can’t confident on Chinese and this is confidential investment on progress. Fail!

Thank you David, we can’t be confident on China’s foreign business activities at least. China is sinking, the once Great China is became again communist dictatorship, the real threat to their Pacific neighbors and less and less foreign business friendly. We can’t trust them anymore!!!

If they have been holding the properties for 2 years, the value of those properties should have increased. If they are strapped for cash, they can take profits by liquidating the assets.

Oceanwide isn’t going anywhere. Meaning unfortunately the site will sit dormant for quite awhile longer.

And nothing of value was lost….

Oh just build the Calatrava design and be done with it.

Despite China Oceanwide claims the activities for 80 South St, news from internal operation is negative. A really shitty management team in charge of this project has gone through the hell. Nothing expect Chinese developers can do a real job at overseas…Don’t trust, don’t deal with them, don’t buy from them…

I saw this tower claims down and the Fire a part of that city and the tower of Matthan I think or other city to I saw this happen on the movie skyscraper and the cast is Dwayne Johnson and his wife and the china on his assignment to do the worlds tallest and safest building catches on fire and his wife named Sarah Sawyer and the kids to on the movie to.